Trade license cancellation in the Czech Republic is the process of canceling a self-employed business. It includes canceling the trade license, social security, health insurance, and income tax registration. To cancel, submit an application to the Trade Licensing Office and complete deregistration with all relevant authorities.

Below, we’ve outlined the necessary steps in 2025 for canceling your trade license and deregistering with social security, health insurance, and tax authorities in the Czech Republic.

Step 1: Trade License Cancellation or Pausing

Your first step is to cancel or pause your Czech trade license. Deactivate your IČO (business registration number) and cancel your trade license at the Trade License Office (Živnostenský úřad) of any Municipal Office (Městský úřad) in the Czech Republic.

Once your IČO number is deactivated, you should stop invoicing as your business is closed and your business number is deactivated. Cancelling your Czech trade license and deactivating the ICO (business registration number) takes only 2 working days.

However, deregistering other authorities in the next steps is important to avoid debts and penalties from authorities!

Step 2: Social Tax Deregistration

Following the trade license cancellation, you must apply for social tax registration cancellation at the Social Tax office. This deregistration sets up the cancellation of the upcoming social security deposits. If you don't cancel your social tax registration, the social tax office will be expecting deposit payments from you which might create debts and penalties.

Step 3: Health Insurance Cancellation

After your trade license is canceled, you should also cancel your Czech health insurance. This deregistration secures the cancellation of the upcoming health insurance deposits. If you don't cancel health insurance deregistration, the health insurance provider will be expecting deposit payments from you, leading to debts and penalties.

If you have family members living in the Czech Republic and have health insurance under your trade license, you should also deregister their health insurance.

If you qualify, register yourself or your family as self-payers of health insurance. Public health insurance for self-payers due to trade license cancellation costs 2,808 CZK per month.

Step 4: Income Tax Office Deregistration

Next, you should deregister from income tax with the financial tax office and cancel your Czech Tax Identification Number (TIN). Starting from 1.1.2024, DIČ (Tax Identification Number) registration or cancellation is not mandatory. That is why tax office employees might deny deregistration application forms for Income Tax.

You need this confirmation of tax cancellation, for example, in your country of origin for new tax residency purposes.

Therefore, it's important to negotiate with the tax office, explaining the importance of having Czech Tax number cancellation and proposing to them to issue you proof of cancellation

Income Tax Advance Payments Cancellation- If you have upcoming Tax Advance Deposits, you should cancel them too. Otherwise, you will have debts to the Tax Office due to penalties and overdue Income tax advance payments.

Step 5: VAT Deregistration

If you had been registered for VAT or Light VAT, you should cancel VAT registration additionally after you cancel your trade license. VAT is not canceled when the Tax number is canceled. Not canceling the VAT number on time can cause penalties of up to 500,000 CZK. Do not forget to declare all pending invoices that you issued to companies registered in the EU for VAT reports.

Step 6: Flat Tax Deregistration

The flat tax is not canceled when you cancel your income tax or trade license. If you don't cancel the flat tax at the Tax office of your district, the tax office will be expecting flat tax payments, resulting in debts for monthly flat tax payments. Additionally, these debts can trigger unnecessary penalties for late payments.

Step 7: Social and Health Contributions Audit

After canceling Czech social tax and health insurance, make sure to get audits from both offices to check if you owe any payments or penalties for late payments. This is important because penalties keep adding up until everything is fully paid.

So, it’s important to find out if you have any overdue payments or penalties to avoid growing debt and extra charges.

Step 8: Income Tax Report

No matter if your trade license was active for one day or a few months during the year. You should complete an annual tax report and recalculate your social tax and health insurance for the current year by the end of March of the following year (deadline). If you miss the annual tax return for the current year, you might face problems and penalties

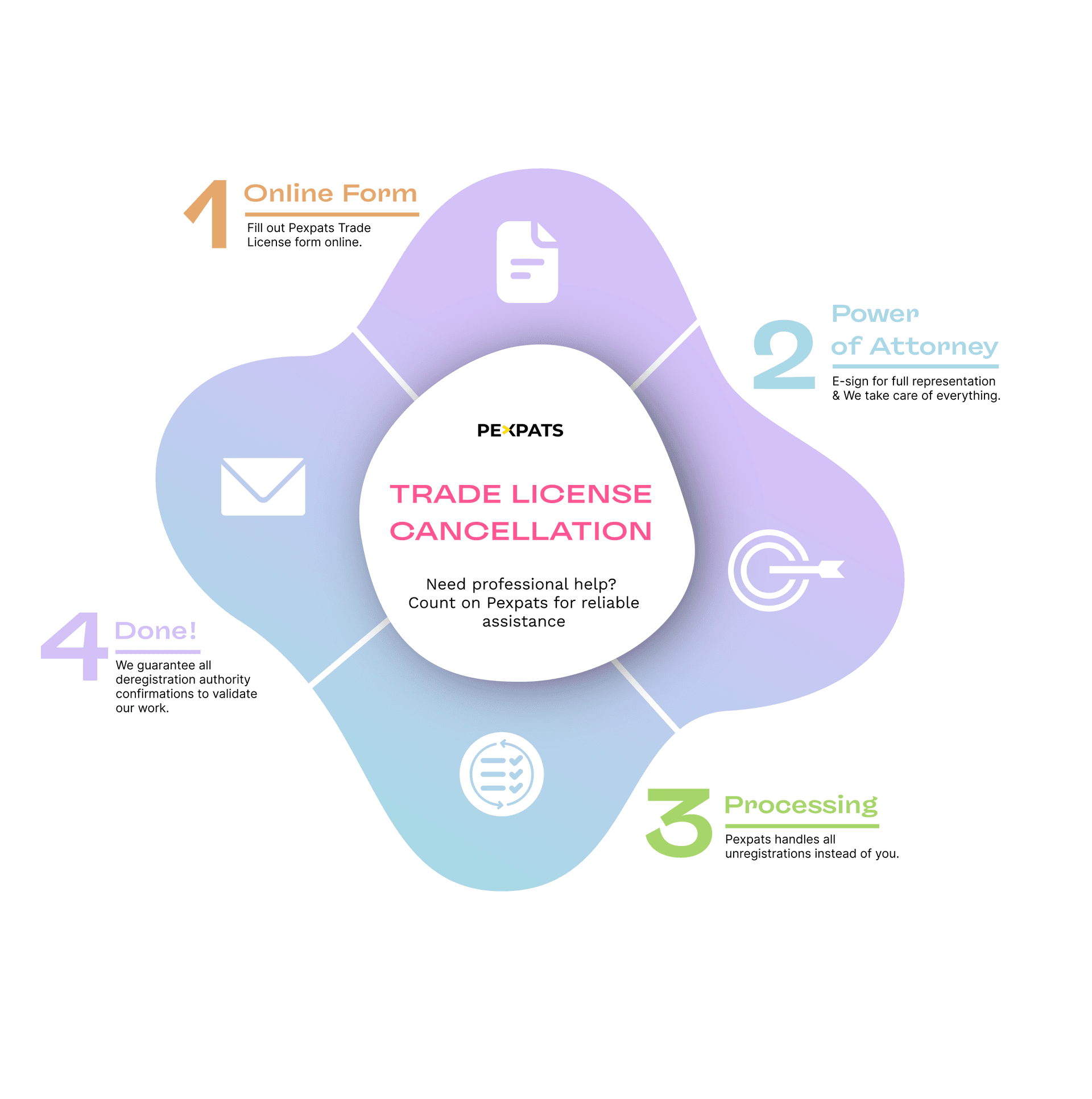

Get Support From Pexpats

If you have any questions or require assistance, feel free to contact us. We're here to help you with the complete cancellation process for your trade license, contribution and tax deregistrations, monthly VAT reports, and yearly income tax reports.

Hear Testimonials from Pexpats’ Satisfied Clients!

Please, clearly describe your situation or questions in detail.

The more information you provide, the quicker and more accurate our response will be.

We reply within the same day. If you do not receive a reply within a day, please check your spam folder.

Have Questions?

If you still have questions, find anything confusing, or haven't found what you're looking for, feel free to contact our agents. We're here to help.

Fill out the form below, describe your situation, and choose the relevant service type. Our agents will prioritize your request and suggest a solution.

What we do

Business Support

Relocation Assistance

Tax Advisory

Freelance Solution Hub

Digital Finance Platform

Services

Immigration Services

Online Tax Report

All-in-one Packages

Financial Services

Immigration Services

Business Services

Personal Services

Copyright 2013 - 2025

Made with ❤️ in Czech republic

Powered by PEXPATS