Understanding Czech tax forms can be confusing, especially when the official forms are in Czech. Here are some common questions people have about taxes, along with simple answers to help you out.

Let's get started! Keep reading below for simple answers to guide you through the most common tax questions and tax forms questions.

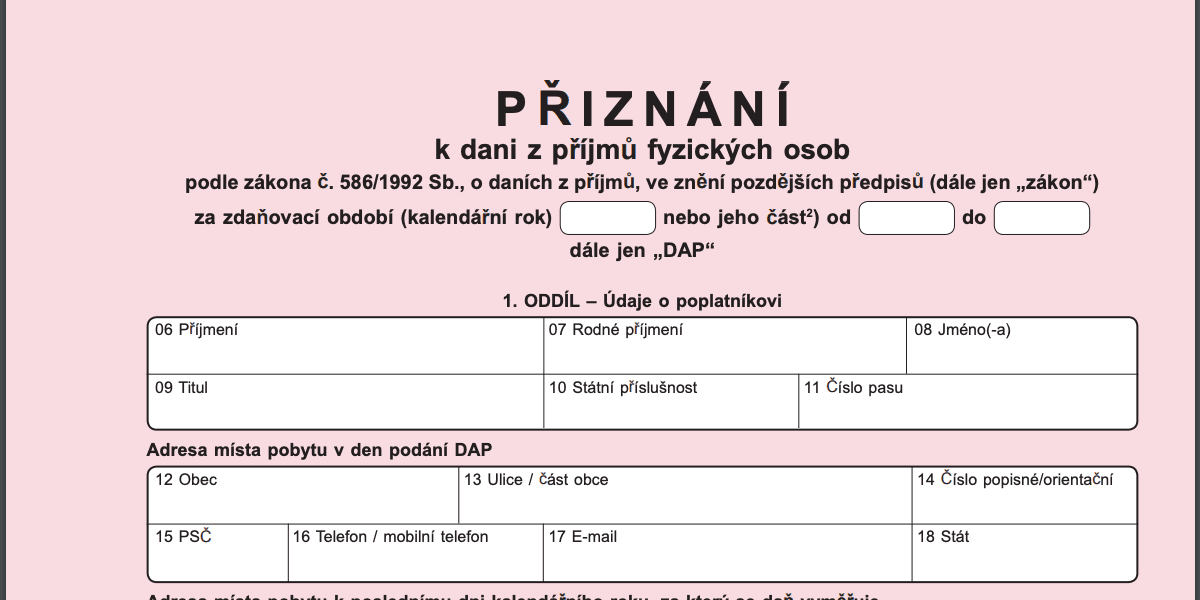

How can I understand Czech tax forms?

Unfortunately, since Czech is the official language of the Czech Republic, all tax-related forms must be in Czech.

The tax base is the amount on which taxes and contributions are calculated. If you are trying to understand the numbers and sections of Czech forms, we have prepared descriptions for Czech tax, social, and health insurance forms in 2025.

A breakdown of the Czech Income Tax form:

- 31 - Your total annual gross salary from employment and trade license (if you had employment and a trade license).

- 37 - Your trade license (OSVC) net income after deducting 60% fully or partly from your gross income in the 60/40 tax method.

- 45 - Total tax base income (if you have multiple sources of income) before deductions.

- 46 - Gift/donation tax deduction amount.

- 47 - Mortgage interest rate tax relief amount.

- 48 - Private pension investment relief deduction amount.

- 49 - Life insurance tax relief deduction amount.

- 54 - Total amount of all tax reliefs.

- 55 - Tax base after tax relief deductions.

- 56 - Tax amount rounded to the next 100 CZK.

- 57 - Income Tax amount.

- 60 - Rounded income tax amount.

- 64 - Freelance tax discount.

- 65 - Tax discount for an unemployed spouse.

- 70 - Total qualifying discount.

- 71 - Income tax after all tax discounts.

- 72 - Kid(s) tax bonus.

- 77 - Income tax after tax bonuses.

- 84 - Total tax paid by the employer (if you had income employment + trade license).

- 85 - Deduction amount of the tax deposit (not social and health) if you paid tax deposit last year.

- 91 - Final tax amount. If the amount is negative, then you will receive a tax refund; if it is positive, you will pay that amount of income tax.

- 101 - Your total income from the trade license.

- 102 - Amount of expenses deduction using the 60/40 method.

- 113 - Tax base/Net income amount.

The Breakdown of Czech Social Tax Form:

- 20 - Trade license Tax Base/Net income.

- 25 - Tax Base from which social tax is calculated.

- 32 - Total social tax you owe.

- 33 - Total social tax deposit paid.

- 34 - Final Balance after total deposit deduction.

- 36 - New Social Tax Deposit.

The VZP form, which can be opened only with Adobe Acrobat, is structured as follows:

- 3 - Trade license Tax Base/Net income.

- 14 - Tax Base from which VZP is calculated.

- 16 - Total VZP/Health insurance contributions you owe.

- 41 - Total VZP/Health insurance contributions deposit paid.

- 43 - Final Balance after total deposit deduction.

- 51 - New VZP Deposit.

Why are my social and health insurance deposit payments different from last year?

Your new social and health insurance payments are based on how much you earned on average each month last year. If your income stays the same this year, as last year, your deposits will cover your insurance and social payments, and you won’t owe anything extra.

If your income goes down, you’ll get some money (part of the deposit) back. If it goes up, you’ll owe more and pay a balance.

When do I have to pay my taxes?

If you owe taxes or contributions, here are the deadlines:

- Social tax balance: 8 days from when it is applied

- Health insurance balance: 8 days from when it is applied

- Income tax: 60 days from when it is applied

- Tax deposits if you qualify: Follow the instructions

Where do I pay my Czech taxes and contributions?

Social tax balance: Same account and reference number as you have been paying your monthly deposits

New social tax deposits: Same account and reference number as you have been paying your monthly deposits

Health insurance balance: Same account and reference number as you have been paying your monthly deposits

Can I lower my monthly social and health insurance deposits due to expecting less income this year?

The new deposit is set considering the monthly average income of the previous year, assuming that you will have a similar monthly average income this year. There is the possibility to propose a deposit decrease, but from our experience and tax rules, it is mostly rejected and creates problems with payments and debts.

For example, your new deposit is 10,000 CZK, and as you are expecting less income and propose the deposit decrease. Due to multiple bureaucratic rules, the decision will take 3-4 months. During this period, you pay less or do not pay a new deposit, and when you get a rejection for deposit payments, you will have a debt for these deposit application processes which you should pay immediately with penalties for late payments.

That is why we never recommend trying to decrease a deposit.

NOTE: You are paying only a deposit, and if your monthly average income this year is lower than last year, you will get part of your deposit payment back as a refund. Or if your average income this year will be similar to last year, the deposits you pay will fully cover your social tax, and you won’t pay any balance next year.

Why do I have to make a Tax Deposit?

If your income is only from your trade license (you don’t have a full-time job), and your income tax amount is over 30,000 CZK, you need to make income tax deposits (not social and health payment deposits).

The amount you deposit will be deducted from your income tax next year. If your income tax amount is lower than the income tax deposit amount or your tax is zero next year, you’ll get a refund.

What's the difference between the side and main income?

- Side income is when you work full-time in the Czech Republic and also have a trade license and freelance business.

- Main income is when your source of income is only from a trade license.

Why should I pay taxes on side income if my employer pays them already?

Any money you earn should be declared, and taxes must be paid on that income. If you have a full-time job, your employer reports your income from that job and pays payroll taxes and contributions on it every month through your salary payroll. But you still need to report and pay taxes on any other income you earn, like from a freelance business or a trade license. That is why you should pay income tax, and social and health contributions from your income from your trade license.

Why should I start paying social and health deposits now if I had low/0 income as a side income last year?

In your first year of having a business license on the side (meaning you have both a job and a trade license), you don’t have to pay social and health insurance deposits. But starting from the second year, you need to start paying at least the minimum deposits.

This isn’t the final amount you’ll pay for social and health insurance; they are only deposits. If your income is low or 0 CZK again this year, you’ll get a refund.

Why don’t the numbers on the Social Security platform match what I need to pay?

We can’t control how often the government platform updates or if there are any bugs. If you have questions or problems, contact the platform owner.

But always follow our instructions for your taxes and payments!

How accurate are the calculations for social and health insurance payments?

The calculations are accurate unless you missed some of the deposit payments last year. They will be checked with an audit, which is applied already after the tax report.

But this doesn’t affect any payments you currently owe! That is why please don’t postpone any payment instructions you receive from us.

If you missed any deposit payments, we’ll let you know after the audit, and you’ll pay them later when we have audit results for social and health insurance payments.

I got a letter from the social office or VZP, should I contact Pexpats?

Usually, we get audit results for tax reports. If you get a letter, it might be a mistake of the tax authorities. Please, let us know as soon as you get any letters.

When will I get my tax refund?

If you overpaid deposits or got kid bonuses and the Tax office, Social Tax office, or Health insurance office needs to refund you a payment, you'll get your tax refund by mid-April.

Why am I getting a smaller deduction for tax relief, discounts, and kid bonuses?

Reliefs, discounts, and bonuses are not always calculated for the full year. It depends on when the tax-deductible event happened. For example, if your child was born on June 28, 2024, and you had a trade license for the entire year of 2024, you won’t get the full-year bonus because you didn’t have a child for the entire year, but you’ll get it for 6 months.

Or if your child was born in 2023 and you had a trade license starting from June 28, 2024, you’ll get the bonus for the full year because you had the child for the entire year. This rule applies to most other reliefs as well, such as mortgage interest relief. You’ll only get relief for the months when the mortgage existed.

Why wasn’t 60% fully deducted from my gross income?

The 60/40 method is used for incomes up to 2,000,000 CZK. After that, any amount beyond 2,000,000 CZK is taxed fully. But, it doesn’t mean that you can’t use the 60/40 method if your income is over 2,000,000 CZK.

Let’s say your gross income is 3,000,000 CZK. For the first 2,000,000 CZK, we use the 60/40 method, which means 60% of it is deducted, leaving 40%. That’s 2,000,000 - 60% = 800,000 CZK (40%). Then, for the remaining 1,000,000 CZK, it’s fully taxed.

So, the tax base in this case is 1,800,000 CZK. But if your gross income is under 2,000,000 CZK, then 60% is deducted from the full gross income amount.

How to calculate tax and contribution estimates?

Czech taxes are confusing and involve multiple rules, conditions, and coefficients or percentages. If you want to calculate the estimate of your taxes and contribution expenses for the next year, please check out our calculator for freelancers. We regularly update the calculator with new rules and law changes in taxation.

Life-Changing Stories from Our Happy Clients

Our reviews say it all! Hear real stories from freelancers, digital nomads, students, entrepreneurs, and expats—who found success with us.

Please, clearly describe your situation or questions in detail.

The more information you provide, the quicker and more accurate our response will be.

We reply within the same day. If you do not receive a reply within a day, please check your spam folder.

Have Questions?

If you still have questions, find anything confusing, or haven't found what you're looking for, feel free to contact our agents. We're here to help.

Fill out the form below, describe your situation, and choose the relevant service type. Our agents will prioritize your request and suggest a solution.

What we do

Business Support

Relocation Assistance

Tax Advisory

Freelance Solution Hub

Digital Finance Platform

Services

Immigration Services

Online Tax Report

All-in-one Packages

Financial Services

Immigration Services

Business Services

Personal Services

Copyright 2013 - 2025

Made with ❤️ in Czech republic

Powered by PEXPATS